looking for a better life • news and pro-enforcement opinion

By D.A. King

By D.A. King

The occasion was Martha Zoller responding to me accurately and repeatedly pointing out that Brian Kemp abandoned not only his campaign promises on “criminal illegals” sometime in January or February 2024 – a Thursday, according to my notes. I noted the remark then but only just found it today. I failed to date it.

Republican radio show host Martha Zoller:

dak

By D.A. King

By now in the ongoing illegal alien invasion and colonization of the United States, even the most unaware Americans must surely recognize the endless effort from the left to intentionally conflate “immigrants” with illegal aliens. And to convince us that illegal aliens are less likely to commit crimes than Americans. The intentional push by the liberal media stenographers to happily assist with the endeavor does not and will not end the activist propaganda campaign.

One of the legacy media/Democrat (my apologies for the repetition) goals is to auto-paint as “anti-immigrant” Americans who demand the nation’s immigration laws be enforced or notice the resulting crime.” It’s a “pro-enforcement opinion on immigration is “hate” effort on the part of media.

Here is a March example from NPR of this pre-planned dishonesty titled “Immigrants are less likely to commit crimes than U.S.-born Americans, studies find” posted after an illegal alien allegedly murdered Laken Riley in Athens. NPR “reporter” Jasmine Garsd quotes U.S. Senator Katie Britt (R- AL): “She (Laken Riley) was brutally murdered by one of the millions of illegal border crossers President Biden chose to release into our homeland. Y’all … as a mom, I can’t quit thinking about this. I mean, this could have been my daughter. This could have been yours.”

NPR in the very next paragraph: “The claim that immigration brings on a crime wave can be traced back to the first immigrants who arrived in the U.S. Ever since the 1980s and ’90s, this false narrative saw a resurgence.”

See what they did there? Illegal immigration is simply “immigration.”

“False narrative” indeed.

Here is another example from the despicable Atlanta Journal Constitution in a recent report on the June Biden-Trump debate (“Hispanic voters in Georgia react to a debate that often centered on immigration”). It’s from their immigration writer, Lautaro Grinspan with assistance from another AJC typist, Helena Oliverio. The piece explains to the reader that Trump asserts the U.S. Mexico border is considered the most dangerous place in the world. He pointed to the fact that illegal border crossings have reached record highs during the Biden administration. The topic is illegal immigration.

The AJC: “While some individuals who entered the country illegally have gone on to commit violent crimes, including here in Georgia, data shows that a vast majority of immigrants don’t. According to a Northwestern University study published earlier this year, immigrants are less likely to commit crimes than U.S.-born citizens (italics mine).

See what they did there?

The AJC’s front page slogan is “The Substance and soul of the south.”

The far-left NPR is also one of many anti-enforcement outlets pushing this gem: “There is also state level research, that shows similar results: researchers at the CATO Institute, a libertarian think tank, looked into Texas in 2019. They found that undocumented immigrants were 37.1% less likely to be convicted of a crime. (italics mine). Not said: CATO is an open borders concern. Readers who doubt that statement should read “Forget the Wall Already, It’s Time for the U.S. to Have Open Borders” – the CATO Institute, July, 2018.

Pro-enforcement readers should know and use some static truth on illegal immigration.

Illegal immigration is organized crime.

Responsible conservatives should fight back by talking back to the left – including media – with an educated voice.

Because silence is consent.

By D.A. King

“The findings raise concerns about national security, as visa overstays were a factor in the 9/11 attacks.”

(NewsNation) — The Office of Inspector General (OIG) revealed that U.S. Customs and Border Protection (CBP) has insufficient information on whether nonimmigrant visa holders have been interviewed by the Department of State (DoS).

A recent OIG report shows that between 2020 and 2023, the DoS granted approximately 7.1 million nonimmigrant visas without conducting in-person consular interviews. During the same period, fingerprints were not collected for an undisclosed number of visa applicants.

In December 2023, DoS and the Department of Homeland Security (DHS) agreed to expand the categories of visas and applicants eligible for interview waivers starting January 1, 2024. The fingerprint waiver program concluded in December 2023….

Read the entire report here.

By D.A. King

“At a recent (FOP) candidate event, both Cobb County Sheriff Craig Owens and his challenger, David Cavender, took some questions from the audience, which included questions about 287(g).”

Simply honoring ICE detainers is not the same as being a proactive partner with federal law enforcement

In 2007, the Cobb County Sheriff’s Office became Georgia’s first local law enforcement agency to partner with U.S. Immigration and Customs Enforcement (ICE) and participate in the critical public safety program known as 287(g). After years of successful identifications and removals of criminal aliens from Georgia, newly elected Sheriff Craig Owens ended the 287(g) partnership immediately upon taking office in 2021. The Biden administration didn’t make any attempt to maintain the partnership, apparently okay with the release of criminal aliens into American communities.

Now, Sheriff Owens is claiming that the 287(g) program is no different than honoring ICE detainers, which is entirely inaccurate and an obvious attempt to hide from his pro-illegal immigration record during an election year.

The fact is this: Without the training and equipment that 287(g) sheriffs receive as part of this critical ICE partnership, Sheriff Owens and his employees cannot identify whether a person they’ve arrested for a criminal act is in the country illegally. That inability to identify criminal alien status has undoubtedly resulted in the release of dangerous individuals back into American communities.

The 287(g) Program Is Critical. As described by ICE, “The 287(g) Program enhances the safety and security of our nation’s communities by allowing ICE Enforcement and Removal Operations (ERO) to partner with state and local law enforcement agencies to identify and remove incarcerated criminal noncitizens who are amenable to removal” from the United States. The program has been key to identifying countless criminal aliens sitting in jails on account of already having been arrested by local law enforcement. Officers working for law enforcement agencies throughout the nation have received training from the Department of Homeland Security (DHS) on how to identify criminal aliens so that the individuals can be handed over to ICE for removal, rather than be released back into their communities.

There are a number of reasons the 287(g) program is critical to public safety. Sometimes ICE is aware that a criminal alien has been arrested by local law enforcement. For example, when a sheriff’s department takes an individual’s fingerprints, after having arrested and booked the individual for a violation of some local or state law, the prints are entered into a federal system and will result in a flag for ICE if the individual is an alien who has had a previous run-in with federal law enforcement (e.g., a previous deportation). In such an instance where a record exists, ICE will generally issue a detainer to the sheriff, requesting that the local law enforcement agency continue to detain the individual until an ICE officer can be sent to the jail and transfer the alien into federal custody. Sanctuary jurisdictions generally ignore these detainers and release criminal aliens back into our communities.

However, there are many instances where an alien arrested by local law enforcement for a violation has no federal record (e.g., they may have entered the country illegally without encountering the Border Patrol), and the fingerprints do not result in a flag to ICE. It’s in these instances where training local law enforcement receives through the 287(g) partnership is critical in initiating the identification and removal of a criminal alien. After making the right inquiries, sheriffs will alert ICE to the potential removability of an individual they’ve arrested instead of automatically releasing them back into the community, where they might reoffend.

Once a Benefit to Cobb County. The 287(g) program was instrumental in identifying serious criminal aliens in Cobb County jails and opponents of immigration enforcement are well aware of this.

Those who oppose 287(g) are explicitly in support of releasing criminal aliens into our communities. The case studies below are a handful of examples of criminal aliens that the Cobb County Sheriff’s Office identified through the 287(g) program. They are available in ICE’s monthly 287(g) reports that the Biden administration stopped publishing as soon as President Biden took office.

Notably, one of these 287(g) encounters occurred right after the current anti-287(g) sheriff was elected (but before he was sworn in, in December 2020) and involved a Jamaican national sentenced to 10 years for armed robbery. Other examples include illegal aliens arrested for rape and child molestation, crimes that one would think a serious sheriff would want to ensure resulted in prosecution and deportation. But under Sheriff Owens, there’s no telling what is happening to individuals with similar records who are arrested by his officers. We do know that they are no longer being identified as removable aliens by his office, and it’s more than likely ICE is not detecting them — since many enter the United States clandestinely on unknown dates — and they are simply being released instead of being transferred to ICE custody.

Why Sheriff Owens wouldn’t want similar identifications of criminal aliens to continue is hard to imagine, but he’s very proud of helping criminal aliens in his jails evade deportation, calling his ending of the 287(g) partnership a “historic moment for Cobb County”. It may be historic in that it’s likely the first time a Cobb County sheriff has moved to protect drunk driving child rapists in our country illegally.

Criminal Aliens Benefit from Cobb County Ending 287(g) Partnership. At a recent candidate event, both Cobb County Sheriff Craig Owens and his challenger, David Cavender, took some questions from the audience, which included questions about 287(g). Sheriff Owens obfuscated… read the entire CIS post here .

By D.A. King

* Related reading: What’s better than instate tuition for illegal aliens? Georgia’s Dual Enrollment program

The slanted weeper below from the far left The Guardian.com is agonizing over Georgia law that excludes illegal aliens from instate tuition in public colleges and attendance at several other taxpayer-funded colleges. But it is useful in that it puts a number of illegal aliens in our high schools. We caution readers to grasp that the actual number is likely much higher because of Biden’s ongoing open border policies. We note that according to federal law illegal aliens are not eligible to work in the U.S.

* Related reading: Who is Emiko Soltis?

_________

TheGuardian.com

31 May 2024

“But even that pipeline doesn’t reach many of the estimated 4,000 undocumented students who graduate from Georgia’s high schools every year, as the much less expensive public colleges and universities remain out of reach.”

“Only hours after Joe Biden spoke at Atlanta’s Morehouse College – a 19 May ceremony watched closely in light of student protests in support of Palestine – a much smaller, visibly different graduation ceremony took place nearby.

The ceremony’s location was not publicized, a nod to past threats the Ku Klux Klan has directed at the school, as well as continuing hate mail and social media attacks.

The school’s director, Dr Laura Emiko Soltis, wore a keffiyeh while addressing parents, faculty and students from the stage. Flor M, a commencement speaker and alumna, quipped: “I know in my heart I will never have to demand a divestment from Freedom U.” The proceedings included a performance of son jarocho, the lively rhythm from Veracruz, Mexico; the 18 graduates and small audience of supporters sang and clapped along.

Graduates here were receiving recognition from Freedom University – the nation’s only program providing free college-level and college prep classes for undocumented students, with studies grounded in a human rights framework. It was the “underground” school’s 10th graduating class since relocating to Atlanta from Athens, Georgia, in 2014, a deliberate move to tap into the city’s civil rights legacy.

In that time, more than half of its 300 or so graduates have gone on to college with full scholarships, and many have participated in advocacy work, particularly involving access to higher education for undocumented students in Georgia – one of the most prohibitive states in the country when it comes to tuition and admissions policies at public colleges and universities.” …more here.

By D.A. King

Being that she has pushed similar goop for a large part of the year so far, we’ll be quite interested to hear what Kemp Republican and radio show host Martha Zoller has to say about the amnesty the Democrats perpetrated yesterday. Having been extremely busy with pro-enforcement matters under the Gold Dome, I haven’t tuned in to Zoller in quite a while. The guess from here is that she slowed down her relentless push for amnesty when Nikki Haley dropped out of the GOP race for president. But maybe not.

For those readers who haven’t heard Martha Zoller’s guidelines for which illegal aliens would be eligible for legalization you can see here and here and here and here for a sample (don’t miss the repeated premise that Gov. Brain Kemp betrayed his promise to go after illegal immigration in Georgia because the number of illegal aliens increased so much after he was elected). The basics of the Martha Zoller amnesty plan include illegal aliens with ITINs, illegal alien DACA recipients, and illegal alien”families” that have been able to dodge nearly non-existent efforts at deportation for twenty-ish years (it varies) should be legalized.

Martha refers to Americans who fight any amnesty as “hard liners.” We note that those “hardliners” include a large majority of Americans, including Hispanic Americans. Most people do not agree with Martha Zoller on her push for amnesty.

We hope to be able to listen in and see what Martha says about the Biden amnesty – here’s a fact sheet on that event from the Immigration Accountability Project in Washington D.C.

Like the proposed Martha Zoller amnesty, Biden’s executive action will likely add a lot of voters to the Democrat’s rolls in the near future.

By D.A. King

Per 8 USC 1304 “(d) Certificate of alien registration or alien receipt card

“Every alien in the United States who has been registered and fingerprinted under the provisions of the Alien Registration Act, 1940, or under the provisions of this chapter shall be issued a certificate of alien registration or an alien registration receipt card in such form and manner and at such time as shall be prescribed under regulations issued by the Attorney General.”

see also:

Per 8 U.S.C. § 1302, all aliens in the United States for 30 days or longer are required to register with the U.S. Gov’t, and § 1304(e) requires they “at all times carry with [them] and have in [their] personal possession any [proof of] alien registration [] issued”.

By D.A. King

From: “D.A. King” <Dking1952@comcast.net>

Subject: Media request – SB 497

Date: June 11, 2024 at 12:37:25 PM EDT

To: Chuck Martin <chuck.martin@house.ga.gov>, “Rep. Chuck Martin” <

Rep. Martin,

I am compiling information and quotes for a write up on the newly re-named High Demand Apprenticeship Program and your amendment on line 201 (SB 497 as passed) which adds “apprenticeships” to the list of public benefits in OCGA 50-36-1.

In addition to the very real possibility that illegal alien employees are participating in the apprenticeship training, my original concerns were that illegal aliens who were also employers can send an employee to be *“upskilled” at taxpayer expense and then collect the contract completion award of up to $50,000.

Having worked with OCGA 50-36-1 since 2006 I am very familiar with the system it creates for verification of “lawful presence” of applicants for public benefits. It appears that by the addition of ‘apprenticeships’ to the list you have improved the HDAP with the requirement that the apprentice applicant be subject to the verification process. As the sponsoring employer is not applying to be an apprentice, it seems that he would not be included in the multiple steps involved in OCGA 50-36-1 – including the affidavit and SAVE verification.

If so, there is still no safeguard against $50,000 of taxpayers money going to reward an illegal alien employer for the upskilling process paid for by the taxpayer.

Question: Was it your intent to omit the employer from a verification process or do you hold the position that the addition on line 201 of SB 497 will somehow include the verification of lawful presence for the employer who sends an employee to be trained, please? If it is the latter, it will help my readers (including many state legislators) if you could offer an explanation of that position.

As you no doubt are aware, there are multiple public examples of illegal aliens running businesses as employers here in Georgia. As I sent to you, Senator Strickland and Gov. Kemp earlier this year, I cite two of those examples here.

Also, senior officials at TCSG have volunteered that H1B workers are already in the apprenticeship program which apparently indicates that employers are being rewarded with up to $ 50K for Georgia taxpayers funding the OJT/upskilling of temporary workers who are supposedly hired because of their specialty knowledge and expertise in the relevant industry. H1B workers in compliance with the federal law on that visa have “lawful presence.”

Question: Do you agree that SB 497 did nothing to exclude H1-B workers from the apprenticeship program?

In addition to my own now widely-read blog, I also write on James Magazine Online, in various Georgia newspapers and at The Federalist. My deadline on gathering information for this educational opinion piece is noon, Monday, June 17, 2024.

I hope you will reply to my inquiry to insure accuracy and fairness in my column.

Thank you,

D.A. King

404-*****

___

Response from Rep.Martin received June 17, 2024 at

Mr. King,

Here are two questions I’ve asked of TCSG and the answers:

H1B status is not considered an awarding factor in the HDCI process. Since the program’s inception, no apprentice supported under the HDCI program has been an H1-B visa holder. While not connected to HDCI Program, USDOL, a federal agency, coincidently offers apprenticeship grants to help employers reduce their reliance on H1B workers. This is unrelated to any apprenticeship funding mechanism offered by TCSG.

2. Is the system aware of any persons receiving the benefit that are not in the country lawfully?

No. All apprentices must be full-time permanent employees of a Georgia business, which are generally prohibited from hiring a person who is not in the country lawfully per federal DHS rules and required to conduct E-Verify on each fulltime employee. As a double check, we are implementing a SAVE verification process for HDCI apprentices moving forward.

Your questions:

Question: Was it your intent to omit the employer from a verification process or do you hold the position that the addition on line 201 of SB 497 will somehow include the verification of lawful presence for the employer who sends an employee to be trained, please? If it is the latter, it will help my readers (including many state legislators) if you could offer an explanation of that position.

No, in fact, I believe the language covers the employer as well. Additionally, ‘Apprenticeship sponsor’ is defined in the bill (lines 116 – 120), so the additional language added to 50-36-1 is a bit of “belt and suspenders” for state verification.

Question: Do you agree that SB 497 did nothing to exclude H1-B workers from the apprenticeship program?

As the name implies, the HDAP is an apprenticeship program. Individuals who meet the requirements for an H1B must have sponsorship, specific skills and are typically over the age of 21, making it highly unlikely such individuals would meet the application requirements; I draw your attention to lines 91 – 98 in the bill defining application requirements.

Best Regards,

Charles E. “Chuck” Martin, Jr.

House Higher Education – Chairman

State Capitol Room 417

Atlanta, Georgia 30034

Phone: 404-656-5064

By D.A. King

Updated 5:38 PM June 15: I think I repaired the typos. I inserted a few more links to educate the reader. dak

Immigration “reform” and a “path to citizenship” would be the largest single addition to Democrat voter roles in history.

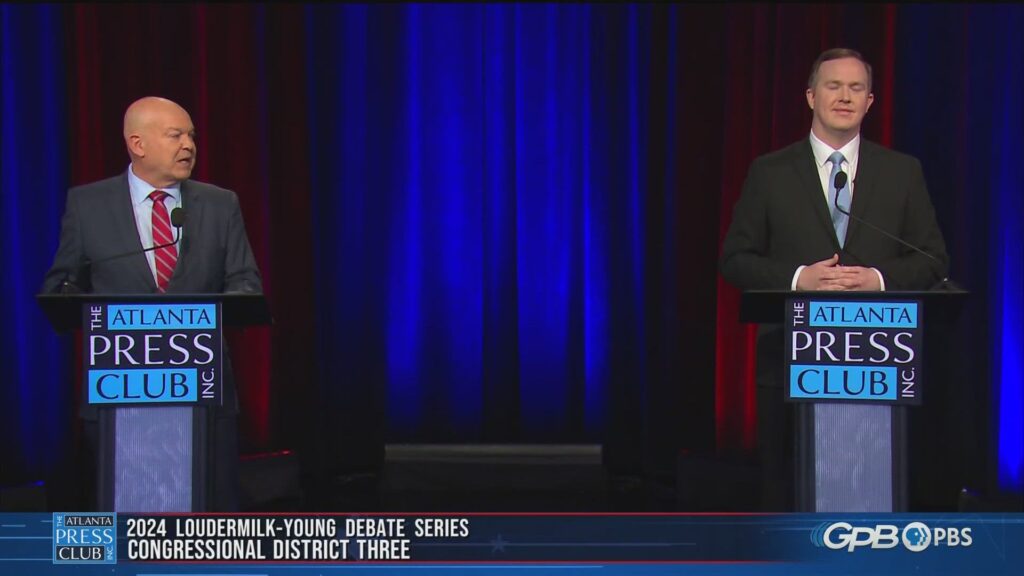

When asked about his “…priority immigration legislation for the country” if elected to congress in the June 9, 2024 GA 03 candidate debate in Atlanta, Mike Dugan replied with an immediate reference to immigration “reform.”

Q: “Senator, while you were working in the State House, you worked on several Georgia-specific ways to regulate immigration. If elected into Congress, the picture gets much bigger in what you could do. What would be your priority immigration legislation for the country?

Mike Dugan: “I think I would… It’s a two-part deal. Uh, first, before we do any immigration reform, we have to shut down the border. The- the border situation right now, it’s a- it’s a local public safety issue, it’s a humanitarian issue, it’s a national security issue. Until we shut that down with federal government working in coordination with the states, not in opposition to, we can’t really discuss immigration reform. Once it… border is shut down, then we do need to take a long, hard look at immigration reform ’cause we need new people coming into the country. We need skill sets that we had… don’t have readily available up in the numbers that we need here in- in the U.S. So that there… It’s a two-part deal, and you can’t do both of ’em at the same time.”

Audio:

A heads-up from here for trusting Republican voters voters who only read the daily headlines and get their “facts” from “the news”: On immigration, “reform” is the establishment code for amnesty. Legalization – like 1986. Make ’em legal – like 1986. Give them a work permit. It’s the mo’ money answer to illegal immigration that has been tossed out by politicians for the twenty years I have been active on immigration. Dugan’s answer is that we will “shut down” the border then we will “reform” immigration so as to create more (legal) workers and then we will import more immigrants because we need “skill sets.”

It’s amnesty and increased immigration – and “we’ll tell you when the border is ‘shut down’. Trust us.”

If voting Republicans were allowed even a shred of useful education and knowledge on the immigration reality and what happened in 1986, Dugan would likely only get votes from the business community.

This pro-enforcement advocate watched Dugan in the state Senate for the entire eleven years he was there. While not very illegal immigration vote he made was bad, many were horrible in that he went along with the “anything for a buck” agenda of the real bosses of much of Georgia state government – The Georgia Chamber of Commerce, the Metro Atlanta Chamber of Commerce, Big Ag and the lobbyists for business interests.

Perhaps the most memorable is Dugan’s support for the 2023 Democrat bill, SB 264 as second signer. That beauty was pushed by a lobbyist for the refugee industry, Darlene Lynch (she/her). Lynch boasts of her partnership with the Georgia Chamber in something they call “Business and Immigration for Georgia (“BIG”)and uses that connect to sell bills to wayward Republicans who are directed to create a larger work force quicker at any cost. (Lynch once promoted the idea of reciprocity in occupational licenses not only with other states, but other nations.)

SB 264 with lead sponsor Democrat Kim Jackson was dropped in the state Senate in February of 2023. When it was presented in the GOP-run Senate Higher Education Committee, it was Lynch who did most of the talking. The entire purpose of the bill was to change long standing state law on the requirement that newly arrived Georgia residents live in the state for twelve months before they can be regarded as “residents” for purposes of instate tuition at our taxpayer funded colleges and tech schools. With Dugan as the number two sponsor, the language of the bill would have allowed foreign nationals who came to the U.S. as refugees, “Special Visa Immigrants” (mostly from Iraq and Afghanistan) and recipients of the biden administration’s seemingly endless “humanitarian parole” to skip the waiting twelve month period – they would have been eligible for the huge reduction in tuition of instate tuition the day they arrived here. Americans moving here from Michigan and the rest of the nation would still be required to wait for a year before qualifying for the lower tuition rate.

I referred to SB 264, Sen. Mike Dugan cosponsor, as (yet another) “Americans last” measure.

It gets worse. When I wrote about the legislation in my regular column in Dugan’s home town newspaper, The (Carroll County) Star News, the editor gave my copy to Dugan who was able to write a rebuttal in the same edition. Point by point Dugan misrepresents the bill and even told readers it had never even seen a hearing – and that it didn’t;t matter anyway because the bill was dead because the 2023 session had ended. The fact is that I watched the hearing, and that Georgia runs on a biennial system for the legislature- the bill was quite alive for the 2024 session. I think he had Lynch write his response to me and never even checked it.

There is a lot more, but if voters liked Paul Ryan and John McCain on immigration, they should look forward to Mike Dugan going to Washington.

I know very little about Dugan’s primary runoff opponent.

Contact info for the Georgia delegation in Washington DC here. Just click on their name.